Embedding a Gender Lens into the Investment Process.

By May Lew, Investment Associate, and Lalit Kumar, Managing Director - Africa

Mar 29, 2021

GIF’s investment mandate is focused on finding and funding innovative ventures and solutions that have high potential to be impactful on the lives of the poor, scalable to reach millions and cost effective. Applying these criteria has meant that GIF’s portfolio has been largely comprised of investments amenable to quantifying impacts generated by innovations (e.g. lives saved, new income generated).

In 2019, GIF set out to find and invest in innovations seeking to reduce agency constraints on women and girls. In early sourcing efforts, a challenge we encountered was finding transformative gender impact innovations which satisfy all of GIF’s core investment criteria. In particular, many innovations lacked a rigorously tested model or clear pathways to scale as we have come to find in established sectors such as agriculture, education and health. Our hypothesis is that this is due in large part to initiatives seeking gender transformative impact having gained increased attention from innovation funders only relatively recently. It became clear GIF needed to challenge itself to redefine what success might look like in the gender investing space, as well as develop a framework and analysis tools to help us think through trade-offs, risks, and opportunities in deals.

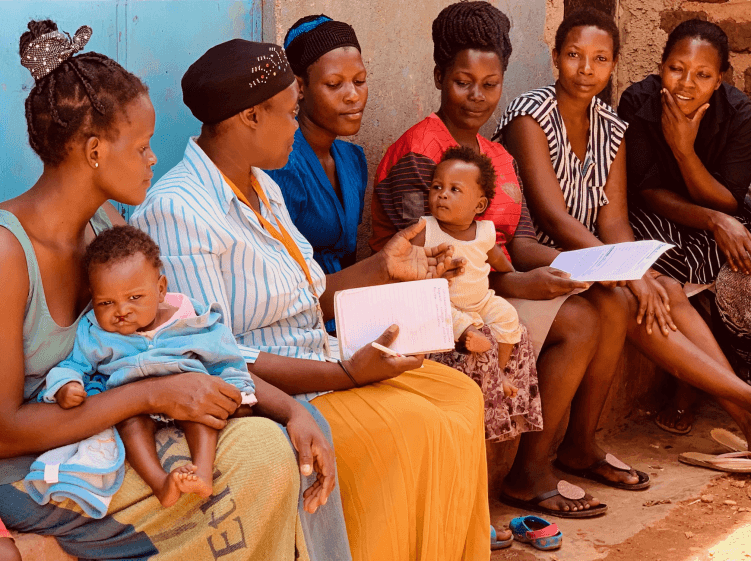

Our early approach to integrating gender analysis involved layering elements of established frameworks into our diligence process. We trialed this process for GIF’s investment in StrongMinds, a mental health organisation working to treat depression in economically impoverished women in sub-Saharan Africa. Through this approach we learned that innovators may be generating, or have the potential to generate, sizeable gender impacts even if they are not yet explicitly considering these impacts or targeting them as primary outcomes. This is a missed opportunity to maximise impact where opportunities to advance agency for women and girls are not well understood or harnessed. Recognising this, we structured our funding to help StrongMinds build gender considerations into its strategy, programme design, and monitoring and evaluation, in addition to supporting StrongMinds’ growth model.

Quickly it became clear that there is value in applying a gender lens more systematically throughout the investment process: it improves our ability to surface risks of adverse impacts on women as well as opportunities for increasing positive gender outcomes, and this potential exists for gender innovations as well as innovations that are not primarily striving for gender equality.

GIF utilizes gender analysis tools to support diligence on all deals and help us think about gender across for-profit and not-for-profit models and against core investment criteria of innovation, scale, evidence, and cost-effectiveness. The toolkit we developed allows for a deep dive into gender issues for gender impact[1]focused innovations and right-sizing of related diligence for innovations primarily seeking other impact outcomes. This toolkit is comprised of:

- The Gender Analysis Framework, a conceptual framework and process guide which maps the gender tools against GIF’s investment process.

- The Gender Marker, which enables a rapid assessment of the gender dimensions of an innovation.

- The Gender Questionnaire, an analysis-to-action tool to help innovators identify specific actions to strengthen strategy, and build capacity of innovators to understand and address gender equality and empowerment.

There is a saying that a tool is only as good as its users. With that in mind, GIF dedicated time and resources to establishing support mechanisms for adoption of these by the investment team and throughout the investment process. For example, GIF embedded touchpoints at the early stages of diligence to allow for forums for the investment team to discuss the output of these tools and the gender dimensions of deals. In addition to consulting with experts, building gender expertise within GIF through hiring new talent has also been an important element of driving and supporting the roll-out of this gender investing approach across the organisation.

In sharing these approaches and tools, we would like this to be useful for other investors and funders seeking to mainstream gender analysis, as well as innovators who wish to better understand the gender facets of their work.